October 13, 2023

This blog post blog post examines Cook County’s long-term liabilities. It includes a review of trends in Cook County’s long-term governmental and business-type activities liabilities, debt service trends and a discussion of its tax-supported long-term debt and recent credit rating changes. This analysis was previously presented as part of the Civic Federation’s annual examination of the Cook County proposed budget.

Long-term liabilities include all of the obligations owed by a government over time. Significant increases in long-term liabilities over time can be a sign of fiscal stress. Between FY2018 and FY2022, the last year for which audited financial information is available, Cook County’s total long-term liabilities declined by 10.4%, or $1.9 billion, falling from $18.9 billion to $17.0 billion. Most of the total five-year decrease was due to decreases in net pension labilities and long-term debt. This is a favorable trend.

Long-Term Liabilities

Cook County’s long-term liabilities include:

- Estimated pollution-related liabilities: This shows liabilities related to remediation of pollution in accordance with GASB Statement No. 49;

- Self-Insurance claims: These are incurred but not yet reported (IBNR) losses. The County reports liabilities it feels are adequate to cover potential losses resulting from medical malpractice, worker’s compensation and general liability claims;

- Property tax objections: Estimated amounts payable related to property tax suits as well as for specific property tax objections and errors for which refunds are expected to be paid;

- Compensated absences: Liabilities owed for employees’ time off with pay for vacations, holidays and sick days;

- Net Pension Liabilities: Cook County reports 100% of the net pension liabilities of its pension fund in the Statement of Net Position to comply with GASB Statement No. 68 requirements.

- Net Other Post Employment Benefit (OPEB) Liabilities: Non-pension benefits provided to employees after employment ends are referred to as Other Post-Employment Benefits (OPEB). OPEB includes health insurance coverage for retirees and their families, dental insurance, life insurance and long-term care coverage. It does not include termination benefits such as accrued sick leave and vacation.

The Forest Preserve District of Cook County is a legally separate unit of government. However, the District and the County share the same governing board. Under the provisions of Governmental Accounting Standards Board (GASB) Statement No. 14, Cook County is considered financially accountable for the Forest Preserve District. Therefore, the Forest Preserve District is reported in the governmental activities of Cook County as a blended component unit and its liabilities are included in the long-term liabilities of the County.

Cook County Long-Term Liability Trends: FY2018-FY2022

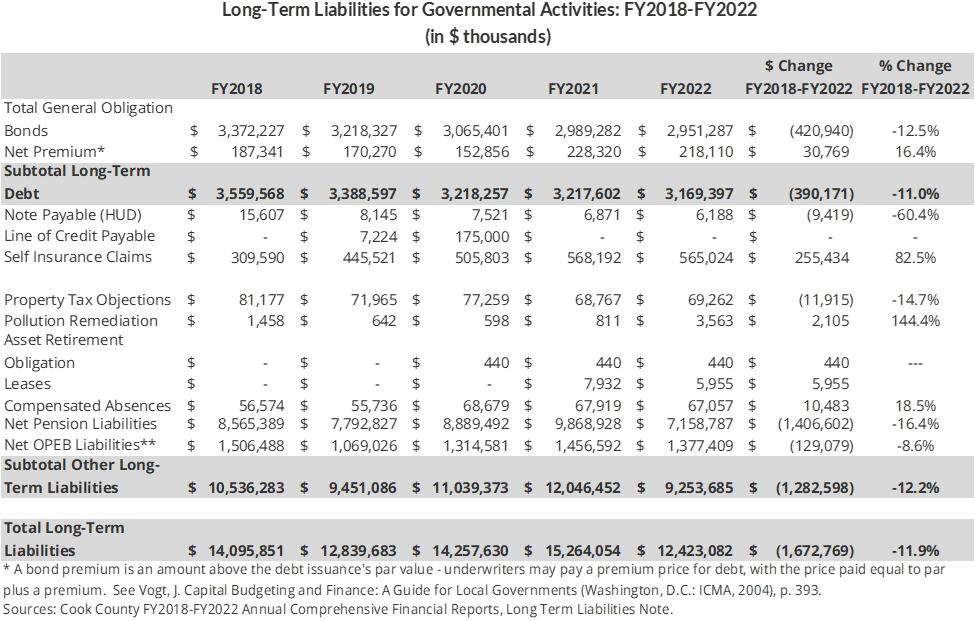

The table below presents the County’s total long-term liabilities, including long-term debt from bonds, leases and other liabilities in the Governmental Funds for the five-year period from FY2018 to FY2022. Figures are based on the County’s audited annual financial reports; FY2022 is the most recent year available. These liabilities are primarily paid for with taxes, such as property taxes and other broad-based taxes such as sales taxes.

Between FY2021 and FY2022, total long-term liabilities fell by 18.6%, decreasing from $15.3 billion to $12.4 billion. Most of the decrease was due to a nearly $2.8 billion decrease in net pension liabilities and net other post-employment liabilities. These liabilities are reported in the FY2022 Annual Comprehensive Financial Report as of December 31, 2021. The pension liability decrease is due in part to the County making supplemental payments to its pension fund and in part to an increase in the blended discount rate used to calculate pension liabilities per GASB. The amount of long-term debt outstanding between those two years also fell slightly by 1.5%, or $48.2 million.

In the five-year period between FY2018 and FY2022, total Cook County long-term obligations fell by 11.9%, or $1.7 billion, decreasing from $14.1 billion to $12.4 billion. The five-year decrease was primarily due to a $1.4 billion decrease in net pension obligations and a $390.2 million drop in long-term debt obligations.

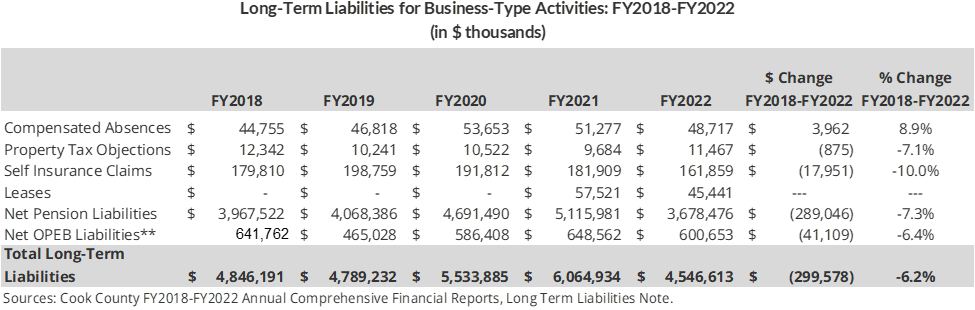

In addition to long-term liabilities in the Governmental Funds, Cook County also has incurred long-term liabilities for its business-type activities, which involve operations of the Cook County Health and Hospitals System (Cook County Health). These obligations are paid for with user fees and charges as well as tax subsidies from the County’s governmental funds.

Business-type long-term liabilities totaled $4.5 billion in FY2022, which represents a decrease of $1.5 billion from FY2021, largely due to a $1.4 billion decline in net pension liabilities.

In the five-year period between FY2018 and FY2022, the total amount of business-type long-term liabilities decreased by 6.2% or nearly $300.0 million, falling from $4.8 billion to $4.5 billion. Most of the decrease was due to a $289.0 million decrease in net pension liabilities.

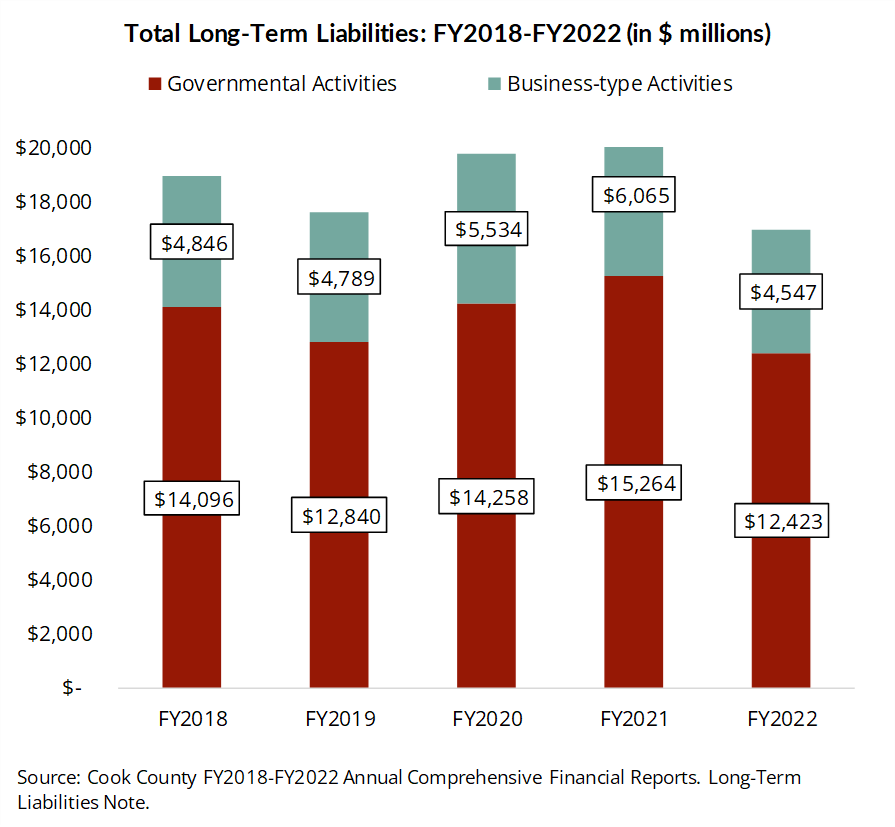

The next chart shows the total amount of Cook County long-term liabilities for both governmental activities and business-type activities. Between FY2018 and FY2022, these total obligations decreased by $1.9 billion or 10.4%, falling from $18.9 billion to $17.0 billion.

Long-Term Tax-Supported Debt

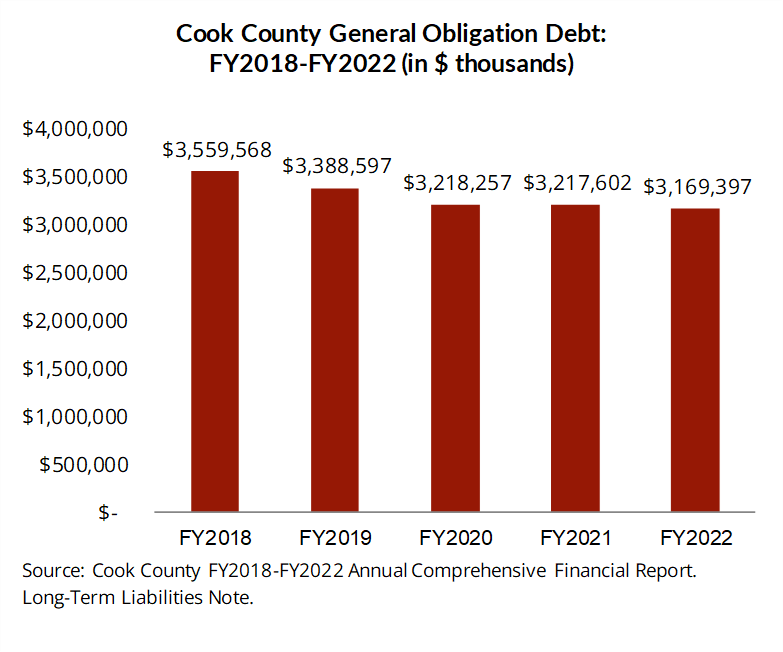

Cook County long-term debt includes tax supported debt, also known as direct debt, as well as bond premiums and debt issuance costs. Increases in a government’s long-term tax-supported debt over time can be a potential sign of rising financial risk.

All Cook County long-term debt is general obligation debt. Long-term debt declined between FY2018 and FY2022 from nearly $3.6 billion to $3.2 billion. This represents a decrease of 11.0%, or $390.2 million.

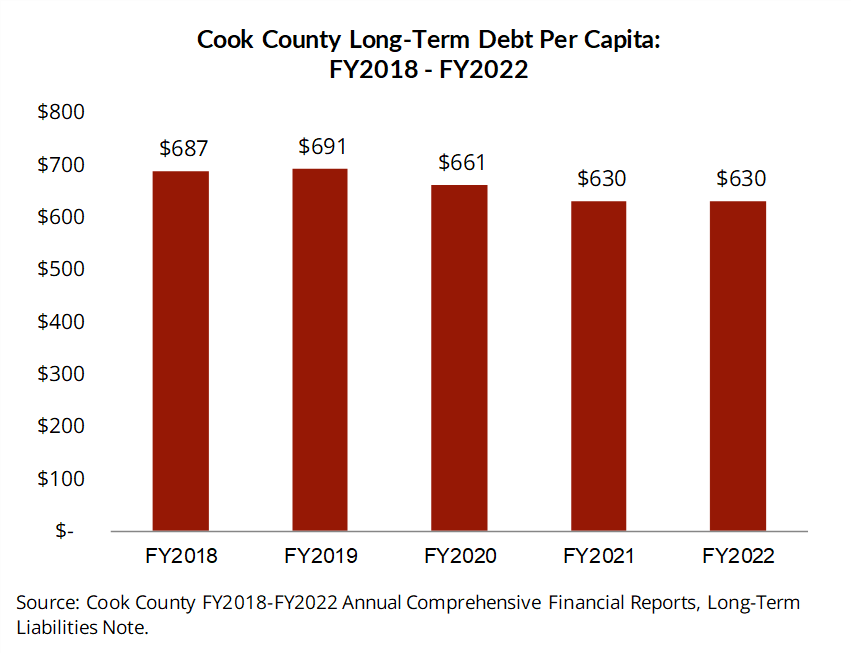

Long-Term Debt Per Capita

A common ratio used by rating agencies and other public finance analysts to evaluate long-term debt trends is debt per capita. This ratio reflects the premise that the entire population of a jurisdiction benefits from infrastructure improvements. Debt per capita is calculated by taking the total long-term debt amount reported in the County’s financial statements and dividing it by the County’s population. The County’s long-term debt includes general obligation bonds payable and bond premium and issuance costs. The County’s long-term per capita debt burden fell between FY2018 and FY2022 from $687 to $630. This is a positive sign, indicating that the County has done a good job in managing its debt burden.

Debt Service Trends

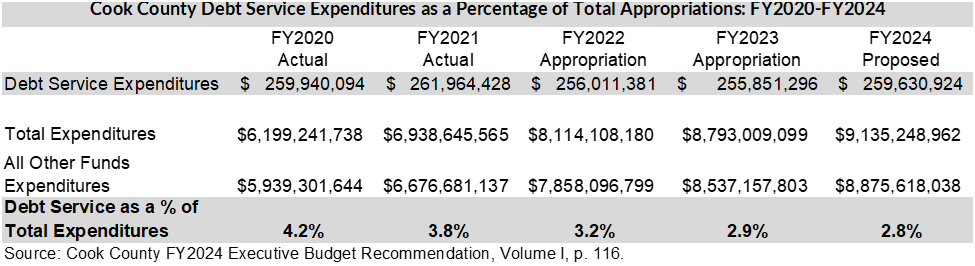

The ratio of debt service expenditures as a percentage of total expenditures is frequently used by rating agencies to assess debt burden. Debt service payments at or exceeding 15-20% of all appropriations are considered high by the rating agencies (Standard & Poor’s Public Finance Criteria 2007 and Moody’s, General Obligation Bonds Issued by U.S. Local Governments, October 9, 2009).

The County has not come close to the 15% threshold in the five years examined. Debt service as a percentage of total expenditures has declined over this period, from a high of 4.2% in FY2020 to a low of 2.8% for the FY2024 proposed budget, as the County’s overall expenditures have grown at the same time. Total expenditures will increase from $6.2 billion in FY2020 to $9.1 billion in the FY2024 proposed budget, while debt service expenditures have remained steady at about $260 million annually.

Recent Bond Issues and Future Financing Actions

In August 2022, Cook County issued $277.7 million in general obligation bonds. Of that amount, $268.5 million was issued in Series 2022A general obligation refunding bonds and approximately $9.32 million in Series 2022B taxable general obligation bonds. These bonds were used to refund the County’s outstanding Series 2021C bonds that mature on or after November 2, 2023. The refunded bonds were called for redemption on November 15, 2022.

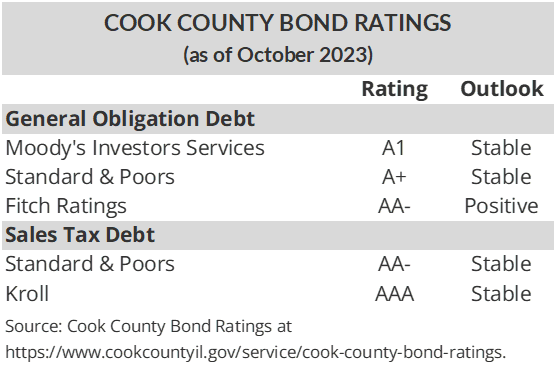

The bond issue received the following underlying credit ratings: A2 with a positive outlook from Moody’s, A+ with a stable outlook from Standard & Poor’s Global and AA- with a stable outlook from Fitch Ratings. Kroll Bond Rating Agency assigned an AAA rating with a stable outlook on these bonds as well, citing the County’s robust revenue base and strong bondholder protections.

According to the recently-released FY2024 recommended budget, Cook County anticipates taking the following financing actions:

- Issuing $175.0 million of Sales Tax Bonds to repay the County’s current tax-exempt revolving line of credit that is drawn upon to pay for capital expenditures;

- Extending its $175.0 million Series 2014D and 2018 Tax-Exempt Revolving Line of Credit in January 2024. The Revolving Line of Credit will be used as a funding source for various capital projects; and

- Extending its $85.0 million General Obligation Bonds, Series 2012B agreement when it expires in August 2024.

Cook County Bond Ratings

The table below summarizes the credit ratings as of October 2023 for various types of Cook County bonds.

Cook County Credit Rating Changes in 2022 and 2023

The following narrative summarizes recent actions taken by rating agencies regarding Cook County debt issuances and credit ratings in 2022 and 2023.

Moody’s Rating Actions

In August 2023, Moody’s Investors Services upgraded Cook County’s credit rating to A1 from A2. The upgrade reflected the County’s strong financial position, its accumulation of reserves and the recent approval of pension reform legislation affirming the County’s use of supplemental funding for its retirement system. This was the second ratings upgrade by Moody’s in less than two years. The outlook was revised to stable from positive.

In August 2022, Moody’s Investors Services assigned an A2 rating to Cook County Series 2022A and Series 2022B general obligation bonds, affirmed its A2 rating on outstanding general obligation debt and raised the outlook from stable to positive. The outlook change reflected the County’s strong financial position and its accumulation of reserves.

Kroll Rating Action

In July 2023, Kroll Bond Rating Agency affirmed its AAA rating with a stable outlook for Cook County sales tax revenue bonds. This was due to strong bondholder protection, a dedicated revenue stream to pay for the debt and the County’s diverse and stable economic base. As noted above, Kroll Bond Rating Agency assigned an AAA rating with a stable outlook on the County’s 2022 bond issuance.

Standard and Poor’s Rating Action

Cook County’s August 2022 Series 2022A general obligation refunding bonds and Series 2022B taxable general obligation bonds received an A+ with a stable outlook from Standard & Poor’s Global. On November 5, 2021, S&P raised the outlook on Cook County general obligation debt from negative to stable while affirming its A+ rating. The change reflected the County’s improved fiscal situation, due in part to the receipt of substantial American Rescue Plan funds from the federal government.

Fitch Rating Action

In July 2023 Fitch Ratings affirmed Cook County’s general obligation (GO) bonds rating at AA- and revised the outlook to positive from stable. The change in outlook reflected the County’s continued improvements in financial management, its strong reserve position and increased pension payments.